Money, Money, Money…in the Rich Man’s World

Well, ABBA should talk. At their peak in the 1970s they were the second largest export earner for Sweden, after Volvo. Light revolutionary lyrics but the foursome’s collective net worth is well over a billion dollars. Thank you for the money.

Songs can mock the evil of riches but money is a big driver in people’s lives, especially in the rich world. Asset prices were driven higher by cheap or almsot zero interest rates. The price of apartments and houses from Melbourne to Toronto has made the word millionaire meaningless. Housing costs are still high but in many places they are starting to retreat, trapping condo flippers.

Toronto Housing Headlines

Both from the Toronto Star.

“A shocking number: Total mortgage balance reaching ‘severe delinquency’ exceeds $1 billion for the first time in Ontario.”

For more on this read the last section of my interview with Jeff Rubin.

Related, and in the same paper, why no one is buying over priced micro condos.

“‘The condo market right now is a ghost town’: Toronto has a record number of units for sale. Here’s why they aren’t selling despite a housing crisis”

These are mostly people who bought condos to rent on AirBnb or to flip. That dam will break soon enough; higher rates will make the debt worth more than the asset. Though The Star linking it to the so-called hosuing crisis is a stretch. Apples and Oranges. Affordability crisis or Nimby crisis would be closer to the truth.

Forbes Rich List: Countries, Not People

Note that Russia is not on this list. Oligarchs rich, people poor.

Rich Countries (Mostly) Attract Tourists

I have been to nine out of ten on this list. Many people in these countries are sick of the tourists taking over apartments and clogging streets and beaches. But will they really give up on all that easy money?

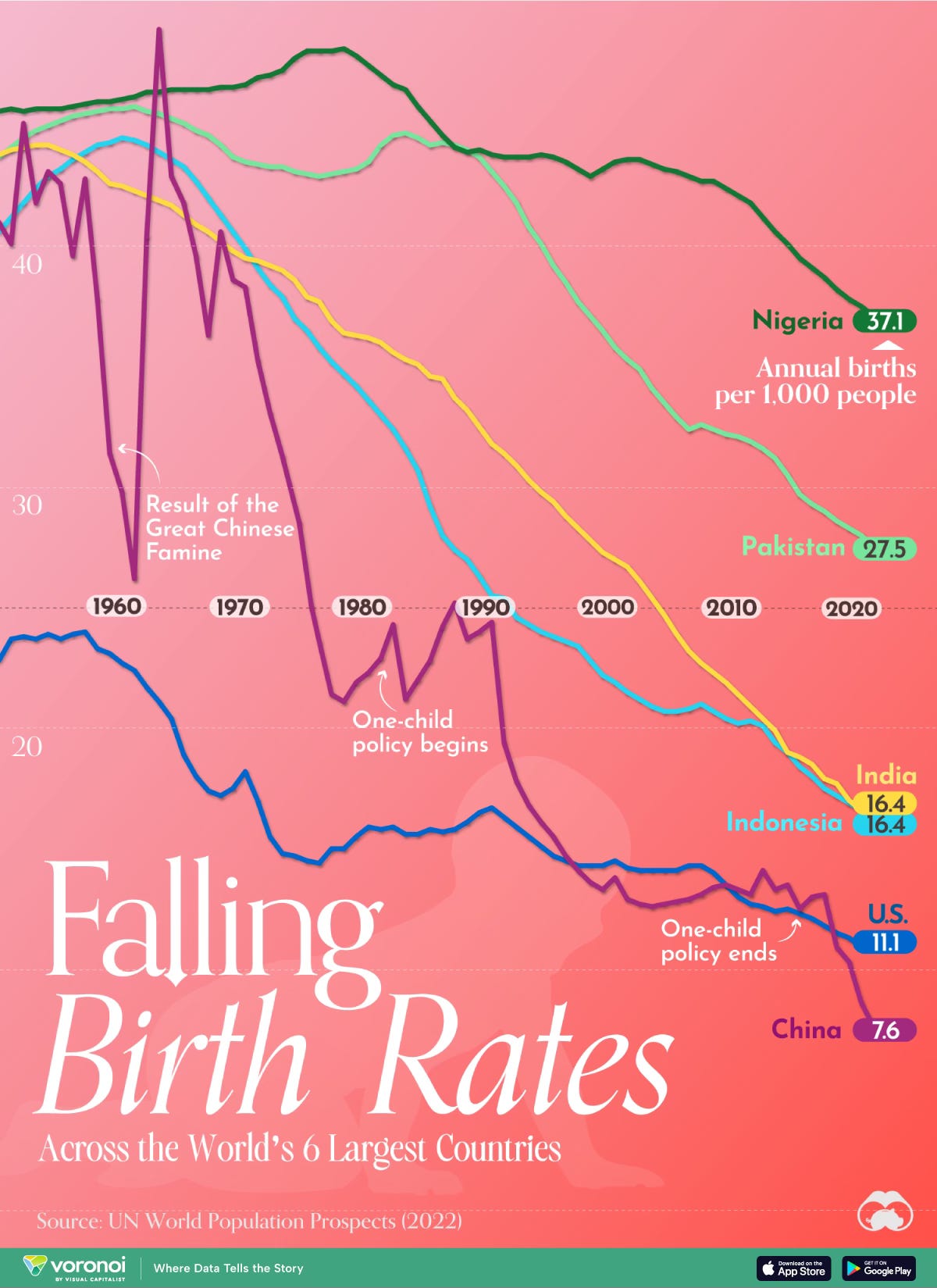

More Money, Fewer Babies

People get richer, more women work and money trumps babies.

Family planning from the top in China, which had a one child policy from about 1978 on dictated by the Central Committee of the Chinese Communist Party. This had many unitended consequences. Male children were preferred so girl Chinese babies were adopted by westerners, female fetuses— discovered by ultrasound— were aborted along with some other horrid practices that the government never intended. Result: many more male adults than females and still fewer births.

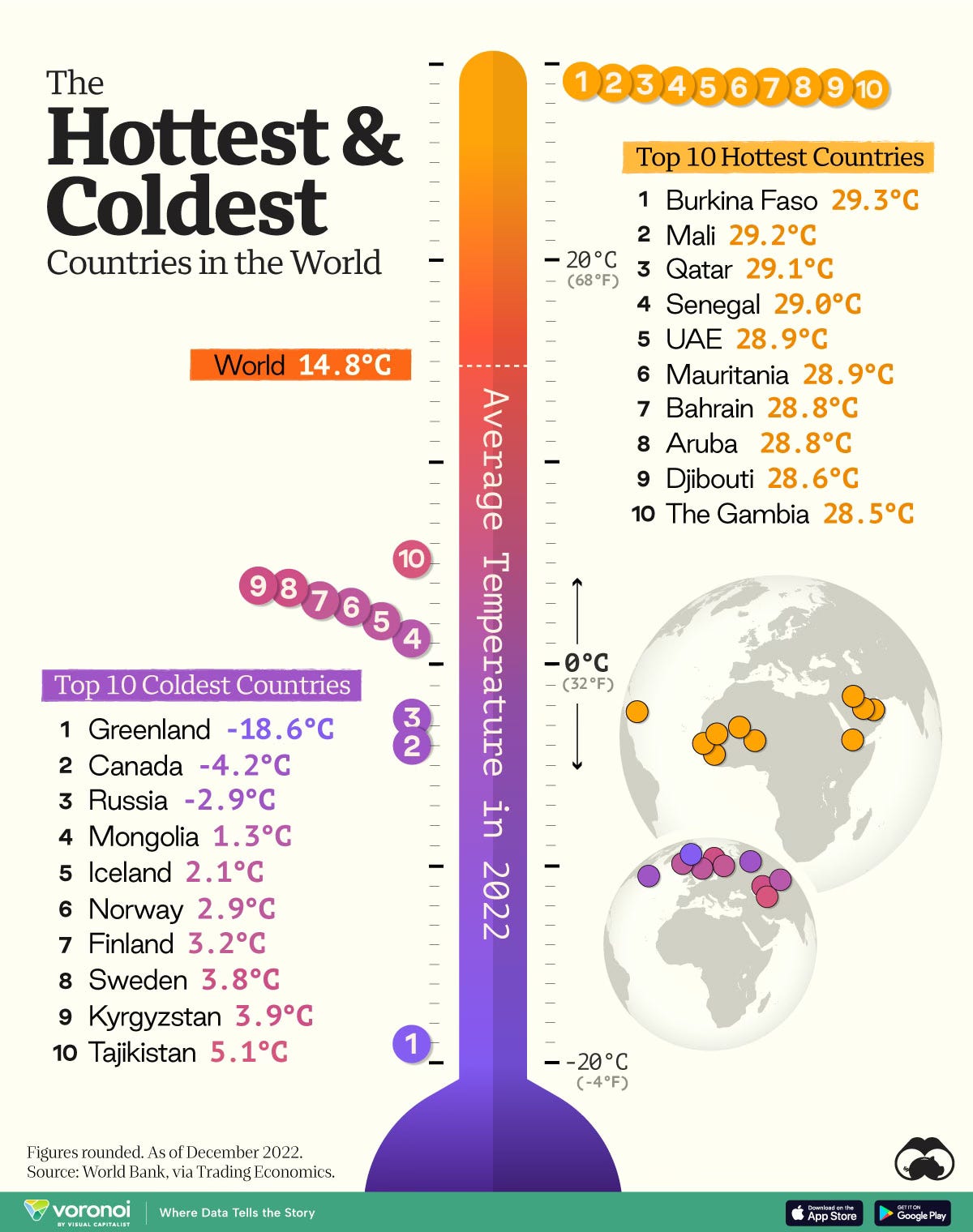

More Money on the Cold List than the Hot List

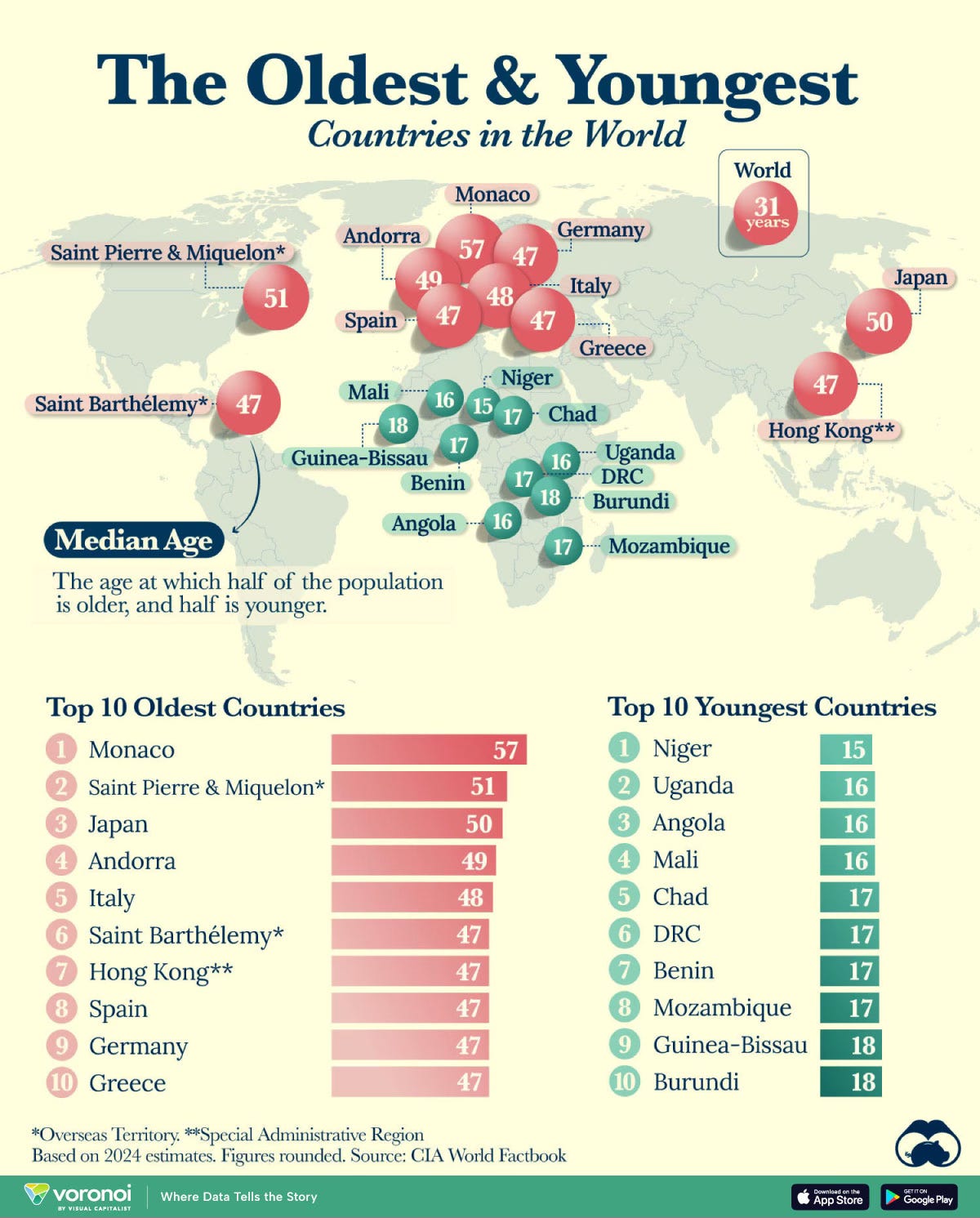

All the Countreis with Young Populations are Poor

If you are wondering where Saint Pierre & Miquelon are, they are the islands off Newfoundland given to France as a consolation prize in the 1763 Treaty of Paris which ceded all of New France, now Quebec, to Britain after the Seven Years War.

Leaders of the Rich G-7 Sink in Popularity at Home

Olof Scholz, Germany; Justin Trudeau, Canada; Emmanuel Macron, France; Giorgia Meloni, Italy; Joe Biden, USA; Fumio Kishida, Japan; Rishi Sunak, Britain.

The photo is from the Daily Telegraph which uses the phrase lame duck, as does Jeff Rubin in the interview below. The only winner is Giorgia Meloni of Italy. Again, read the interview below to see why most of these leaders will soon be history, some much sooner than later.

Essay— Actually Interview— of the Week

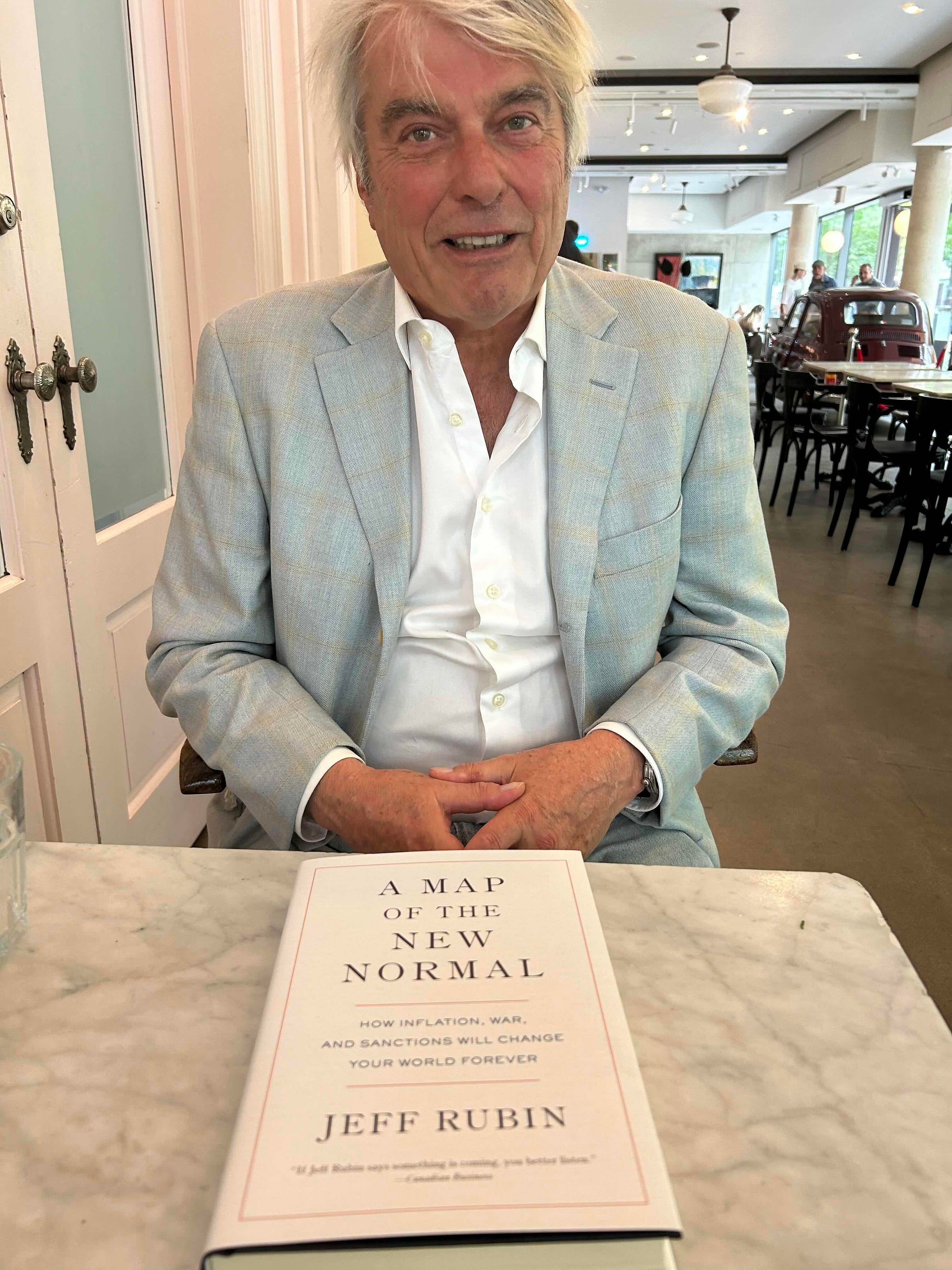

This week an interview with economist Jeff Rubin, the best known economist on Bay Street when he was at the CIBC, and now a best selling author. His latest book is on the Globe and Mail best sellers list. I spoke to him on Thursday in Toronto.

Jeff Rubin: A Map of the New Normal: How Inflation Sanctions and War Will Change Your Life Forever (Penguin Random House Canada)

Fred: So what is the meaning of the title of your book, The New Normal?

JR: The new reality is the way in which our economy is going to operate very differently than the way it has operated in the last three or four decades.

Fred: What caused this?

JR: It was caused by the collision of two worlds: the old world dominated by the United States and its Western allies and the new world order which includes the economic behemoths like India and Brazil aligning themselves with America’s traditional enemies, Russia and China. Where these two orders clash there is conflict. We all know the military theatres, Ukraine and Gaza and possibly the straits of Taiwan, but the actual main battlefield is economic, and the major weapon is sanctions.

Fred: In your book, you say there used to be 4% of sanctions forty years ago and that’s now much higher.

JR: In 1960 about 4% of world trade was subject to global sanctions and it’s now over a third and at the rate at which they are being applied, in a year or so it will be 45 or 50% of world trade. So that means that there has been a huge re-routing of global trade flows because over a third of it is sanctioned. The most obvious example is how Russian energy that used to go to Western Europe now goes to India and China.

Fred: Even since your book came out, I think Europe put a tariff on Chinese cars just this week.

JR: Right and there was the 100% tariff on Chinese batteries. And it’s not like these trade restrictions are one way. China will reciprocate, they will find an area where they can do it. This is ever-escalating; there’s a G7 meeting on right now where, at the end of it, they are going to announce yet a twelfth round of sanctions against Russia. But what people don’t understand is sanctions have always been, and particularly now, a double-edged sword meaning that they often wound the very countries that wield them. If you doubt that, just walk into a grocery store or fill up your tank.

Fred: There’s a picture of the leaders of the G7 and above their heads is their ratings.

JR: Yes, and probably five of them won’t be attending the next G7 summit meeting which is in Canada .. you know why? Because they will no longer be in power.

Fred: Why won’t they be in power?

JR: Well, certainly in Europe’s case and possibly the United States’s case the key reason will be immigration and the War in Ukraine. In France and in Germany the populist right has made huge gains in the EU Parliamentary elections and the policies of the National Rally and the Alternative for Germany are 1) to clamp down massively on immigration particularly from Africa and the Middle East and 2) to end military support of the regime in Ukraine. Turning to the United States, the former incumbent who is now leading, President Trump, also would end military assistance to Ukraine and of course, his biggest issue is to stop the flow of illegal immigration over the Mexican border. But you are absolutely right, this is a lame duck G7 meeting because most of the people there won’t be there next year.

Fred: Lame duck. That’s exactly what the headline is in the Daily Telegraph.

JR: That’s what I say as well so , who cares what bold declarations G7 leaders make at this meeting, they won’t be around to enforce them. Not only that, the people who will replace them have very different views on the War in Ukraine and the EU and on immigration.

Fred: How does this play out for the average Canadian, American or European consumer for instance?

JR: The most notable impact is that inflation is not only back but it’s here to stay.

Fred: Why?

JR: Because it has metastasized. It started off in energy and food because when you sanction the world’s largest energy and grain exporter it has consequences for the prices of alternative supply. And guess who the world’s greatest grain and energy exporter happens to be? Russia. So, it’s a little bit different than sanctioning Iran; you’re sanctioning a massive resource producer. So, what started off in food and energy prices that suddenly pushed headline inflation to rates that we haven’t seen since the 1970s, has now metastasized (just like a cancer that goes from a local tumor and spreads through your body) because now it’s into wages and wages just don’t affect the prices of oil and food, they affect the price of everything.

Fred: What about competition? China is producing cheap electric cars and if they are shouldn’t the likes of Joe Biden and Stephen Guilbault and Trudeau be saying, ‘gee, that’s a great idea, we can electrify the car?’

JR: It’s funny how environmental goals, even for the environmentally self-righteous quickly get shoved into the back seat when energy security is on the table. For example, in Germany of all places, there is a renaissance of coal usage because what has replaced Russian natural gas isn’t solar and wind, it’s re-opening mothballed coal plants and building thirteen LNG terminals for US LNG. Now, in Biden’s case it’s more important to hurt China than to meet zero-emission vehicle targets or to meet our de-carbonizing the grid target,.

Fred: Does the anti-nuclear thing in Germany …

JR: Well, that certainly didn’t help and the Greens by the way were punished in the EU elections by the Alternative for Germany because the Greens insisted that compounding the problems of losing 55% of your gas supply which used to come from Russia the Green party insisted that the country close the remaining three nuclear power plants. The quid pro quo was that they re-opened ten shuttered coal plants.

Fred: And that’s the most polluting type of coal, right?

JR: Yes. Per unit of energy coal is 50 per cent more polluting than natural gas. It will be interesting to see if future administrations in Washington will make the same choice that the Bidem administration has made. , By that I mean will they continue to sacrifice their environmental goals in order to try to punish China or whether that will change in future administrations. And don’t forget that the current t Biden administration has all the pretentions of being very environmentally concerned yet they have insured that they will not be able to hit any of their emission targets because of the actions they have taken against Chinese batteries and Chinese solar panels.

Fred: How long is this going to last?

JR: This is the new normal. The old normal lasted since the Bretton Wood agreement, about seventy years. The War in Ukraine may not last more than six months but that’s just a fault line. The two colliding plates will create all kinds of fault lines all over the place but if you mean how long are the two plates going to collide, that’s the new normal.

Fred: George Orwell talked about the world being divided into three blocks and now you have Brazil, South Africa, China, India and the United States and Europe and Oceana and whatever, is that coming to pass?

JR: Well, BRICS (Brazil, Russia, India, China and South Africa) as you know, just doubled in size and there is a lineup around the block to join and soon BRICS will have a GDP bigger than the G7, over half the world’s population, half of the world’s oil reserves, two-thirds of the world’s natural gas reserves so it’s no longer the case where the US can use its once unchallenged economic and military weight to tell the rest of the world how to act.

Fred: To finish up, who winners and losers, people and countries?

JR: The winners so far, the five fastest growing economies in the last twenty years are: China, Russia, India, Brazil and Saudi Arabia. The US was twelfth, we (Canada) were eleventh. So, BRICS is going to win, not in the sense that North America is going to be invaded but it’s no longer Washington telling the rest of the world what to do.

Fred: What about individuals?

JR: Okay, the biggest winners are the same people who were the biggest losers in globalization. The biggest loser from globalization was the middle class: high-paid factory workers because they were the first to get fired when theier shops were tf gutted and moved en masse to China. But now, all of that is coming back and all of a sudden those far-flung supply chains are not working, which means ‘Make Stuff Here’. We are going to start making things that we haven’t made in decades and there are going to made by be high-paying jobs because now workers can go on strike and the employer just can’t say ‘we’re moving the factory to China’. They have to deal with them and that’s why wages are growing at 6%. But if wages are growing at 6% in the US, how is it that we still have a 2% inflation target?

Fred: You mean it’s going to go higher.

JR: That inflation target was designed for a different world and a different economy. The pre-sanctions, pre-covid economy is a totally different animal than the post-sanctions, post-covid economy and the main difference is you just can’t arbitrage wage costs like you could before across the world.

Fred: In the late-1970s when there was ‘stagflation’, you could buy a house and just wait because your mortgage would disappear because, with inflation, your salary would go up. Is there a way to beat the system now?

JR: Let me tell you what’s happening in the mortgage market: it’s the opposite of what you suggest. Twenty percent of all the mortgages out there in Canada by the chartered banks, BMO, Toronto Dominion and the CIBC, a hundred and thirty billion dollars of residential mortgages have negative amortization. Do you know what that means? Your monthly payment doesn’t even cover all of the interest costs so the uncovered interest costs gets capitalized and added to your mortgage so that instead of paying your mortgage off over time, your mortgage increases over time. The last time that happened was 2007/2008 and we all know what happened to the housing market back then.